INSIGHTS AND ANALYSIS

Flexible Pricing: The Key To Unlocking Incremental Volume

Problem Statement

Enterprise B2B relationships are often dynamic and complex. It is critical that buyers and suppliers have the flexibility to negotiate terms that meet the needs of both parties. Pricing is one of the key factors that can help define a successful relationship. Unfortunately, legacy payment systems often rely on rigid “one size fits all” pricing rules, resulting in lost volume and opportunity. Pricing flexibility, with deliberate and surgical use of proprietary rates, is the key to unlocking incremental volume and growing your program.

Insights

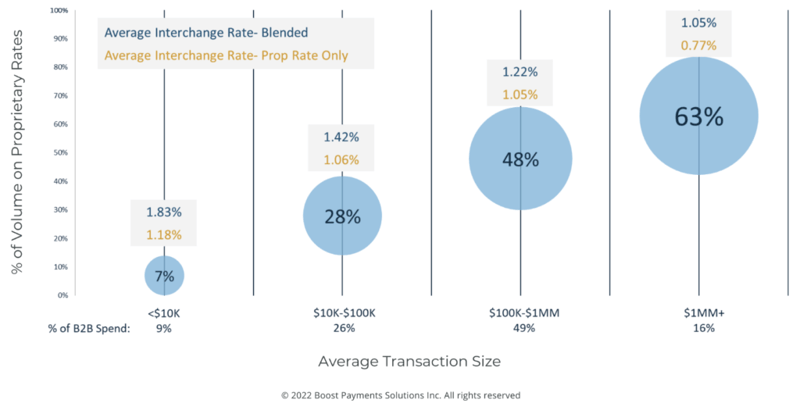

65% of B2B volume has an average ticket of over $100K, where Level 3 and Large Ticket are often not enough to encourage suppliers to accept cards.

More than 50% of transactions over $100K are processed with Proprietary Rates.

on average, proprietary rates are 28 bps lower than the total blended rate.

More than 50% of transactions over $100K are processed with Proprietary Rates.

on average, proprietary rates are 28 bps lower than the total blended rate.

Proprietary Rate Usage By Transaction Type

Proprietary data from across Boost’s network shows that proprietary rates are often required to expand volume in higher average ticket ranges.

Guiding Principles For The Use Of Proprietary Rates

At Boost we use an analytical approach to AP file segmentation to identify when and how prop rates should be offered.

We have identified three situations where a flexible pricing program should be considered to maximize program revenue.

When used strategically, prop rates can significantly increase payment volume and revenue with minimal impact on overall effective interchange rates.

The program adds incremental volume that otherwise would not be on the credit card rails

The program brings back attrited spend from a supplier that has stopped accepting

The program aids in saving at risk spend from suppliers threatening to stop accepting or to begin surcharging

Case Study

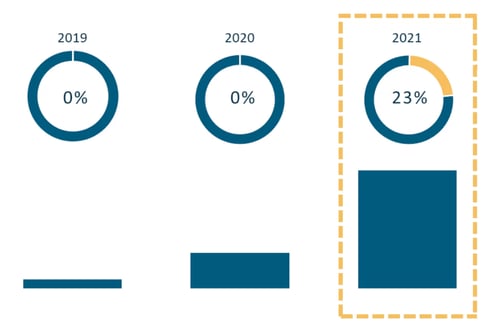

A major US Issuer embraced prop rates in 2021, resulting in positive impact on revenue and volume.

% of Volume on Prop Rates by Year

Annual Processing Volume By Year

+241%

YoY increase in processing volume

+233%

YoY increase in interchange venue

-4bps

total decrease in effective interchange rate

About Boost

Boost Payment Solutions is the global leader in B2B payments with a technology platform that seamlessly serves the needs of today’s commercial trading partners. Our proprietary solutions eliminate friction and deliver process efficiency, data insights and revenue optimization. Boost was founded in 2009 and operates in 45+ countries.

www.BoostB2B.com

@Boost Payment Solutions

@Boost Payment Solutions