Automated claim payment solutions for Payers and Providers

Problem Statement

The payment of healthcare claims relies on a large network of Payers and Providers, creating a complex environment filled with inefficiencies and high costs. When banking information is not available, Payers frequently pay their Providers with virtual cards. To accept these payments, Providers must use inefficient manual processes, such as typing card numbers into desk top terminals or unpacking card numbers and entering them into a gateway. Not only does this introduce risk to the Provider, it is also expensive. Payment processors will typically surcharge for these entry mechanisms, often costing the Provider up to 5% per transaction. Additionally, the Provider’s staff is responsible for manually reconciling the payment into the Practice Management Software / ERP based on the separately provided 835. The end-to-end experience is cumbersome and error-prone, resulting in dissatisfaction for both Payers and Providers.

Solution

Boost Payment Solutions can address the key pain points of the healthcare claims payment process with our Virtual Healthcare Lockbox, powered by Boost Intercept®. Payers send virtual card reimbursements directly to the Provider’s Virtual Healthcare Lockbox, where it is automatically processed and directly deposited to the Provider’s bank account, along with the reconciliation 835 file. This fully-passive process removes any manual intervention on the part of the Provider and creates end-to-end payment and data automation. In addition to ensuring timely payments and reducing operational costs, Boost will always default to the optimal interchange clearing rates to minimize the overall cost of acceptance. Boost Intercept can also add value to Practice Management and ERP software platforms whose clients demand a user-friendly experience with integrated payment options, end-to-end automation, purchase transparency and data security.

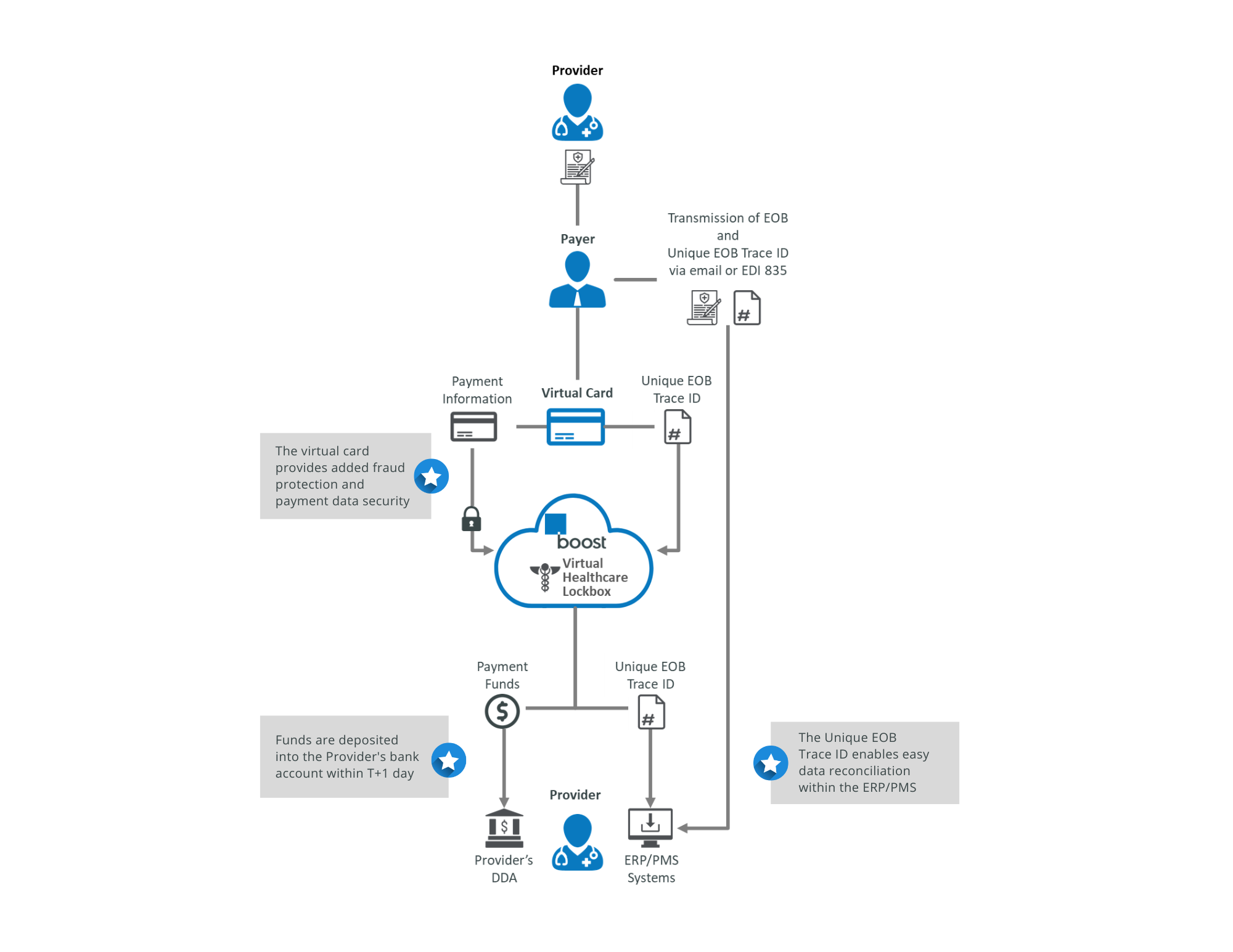

Healthcare Claim Payments Sample Transaction Flow

Step 1

The Provider submits a claim to the Payer

Step 2

The payer approves the claim and sends the EOB and Unique EOB Trace ID to the Provider

Step 3

The payer triggers a virtual card payment with the Unique EOB Trace ID to the Provider's Virtual Healthcare Lockbox on the Boost Intercept platform

Step 4

Boost authorizes the transaction and delivers the payment funds directly to the Provider's bank account

Step 5

Boost sends the payment data and Unique EOB Tracer ID to the Provider in their preferred formats for easy integration into their ERP/PMS

- Fully passive end-to-end experience

- Consolidated payment and EOB reconciliation in one

- Quick and easy implementation

- Optimized cost of acceptance

- Fraud reduction

- Increased data security

- Customized solutions to meet your needs

About Boost Payment Solutions

needs of today's commercial trading partners. Our proprietary solutions eliminate friction and deliver process efficiency, data insights and revenue optimization.

@BoostB2B

@Boost Payment Solutions