It’s without saying that in today's fast-paced business landscape, efficiency and speed are essential for staying ahead of the competition. This is where Straight-Through Processing (STP) comes in, a revolutionary solution that enables businesses to expedite financial transaction processing while reducing errors and eliminating repetitive tasks. Specifically in accounts receivable, an STP solution can transform the way payments are collected and reconciled by reducing manual interventions, errors, and streamlining data sharing.

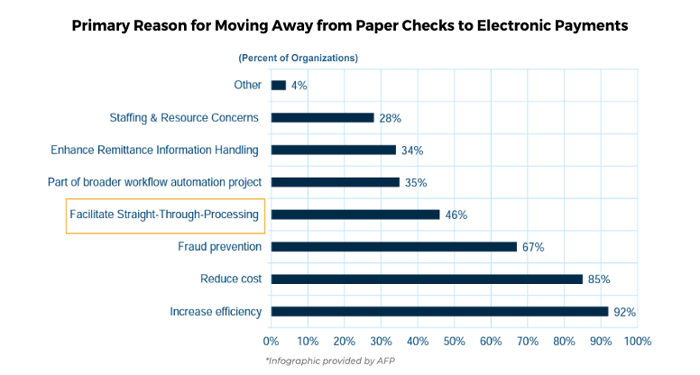

B2B businesses stand to gain the most from STP. Many of these organizations still rely heavily on paper-based processes and traditional check payments, which can be time-consuming and prone to errors. However, by implementing a payment processing software equipped with STP capabilities, these companies can experience significant improvements. In a study provided by AFP, 46% of organizations stated that the primary reason for moving away from paper checks to electronic payments was to facilitate STP for their business.

So, what is so great about STP and how does it work? Let’s get into it.

What is STP?

At its core, a Straight-Through Processing (STP) system is designed to expedite the remittance and settlement process for payments. The primary objective is to streamline payment operations, ensuring that once a transaction is initiated, all the necessary activities involved in the payment processing are automated from beginning to end. The beauty of STP lies in its ability to eliminate the need for manual intervention, resulting in a considerably faster and more efficient payment workflow.

Traditionally, when payments were received through paper-based or manual methods, numerous steps had to be completed before confirmation. This involved tasks such as initiating a telephone confirmation, coordinating transfers across different departments, and enduring a waiting period for funds to be received and processed by the recipient's bank. However, with the implementation of STP initiatives, this arduous process has been revolutionized.

By leveraging high-quality STP solutions, such as Boost Intercept®, businesses can integrate payments directly into their digital Enterprise Resource Planning (ERP) platforms. This integration enables the automatic tracking and transfer of payments, all within a secure and streamlined framework.

A Deeper Dive into the Benefits of STP

Faster Payments: Significant reduction in processing time, resulting in faster transaction turnaround and shorter payment cycles. With STP, businesses gain enhanced control over the timing of each transaction, allowing for better financial planning and management.

Accurate and Actionable Data: Eliminating the need for manual data entry and processing with STP greatly reduces the risk of errors and contributes to better data availability, reliability, and overall accuracy.

Real Time Insights: STP provides businesses with greater visibility into their transactions and cash flow. Real-time insights enable businesses to make informed decisions promptly and respond swiftly to changing market conditions.

Increased Efficiency of AR (Accounts Receivable) Staff: By automating repetitive tasks and reducing the need for manual intervention, AR teams can redirect their focus towards higher-value activities such as strategic financial planning, customer relationship management, and fostering business growth.

“Embracing Straight Through Processing isn't just an option; it's a strategic imperative for B2B businesses. By automating and optimizing the flow of transactions, STP enhances efficiency, minimizes errors, and amplifies productivity, allowing enterprises to focus on innovation and meaningful connections,” says Seth Goodman, Chief Revenue Officer at Boost.

Getting Started with Finding the Right STP Provider

Choosing an STP solution that works with existing software is important. With Boost Payment Solutions, your company can process payments securely and quickly with easy integration and automation of payment and accounts receivable processes. Accelerate your cash flow and streamline operations with Boost today.