The State of B2B Payments: How Finance Leaders Are Driving Digital Transformation

Executive Summary

When it comes to business-to-business (B2B) payment processes, it can be tempting to assume that we’re on safe ground; after all, most of us have at least some experience of business-to-consumer (B2C) transactions – that is, being customers– and payments are payments, right? But the truth is that our familiarity with B2C transactions can mislead us. Beyond the simple exchange of money for goods and services, and despite their long having been conceptually intertwined, B2B payment transactions differ significantly from B2C transactions. Moreover, many B2B systems were built simply by adapting existing B2C payment architectures, and these frameworks were not designed to address the unique complexities of B2B payments. Compounding the issue, much of this infrastructure has evolved slowly, leaving gaps in efficiency and effectiveness.

As a result, when companies approach B2B payments as though they were identical to B2C, they risk overlooking a critical opportunity: leveraging payments as a source of value creation and strategic advantage.

KEY FINDINGS

- Working on it: Almost half of all companies (44%) indicate that their B2B payment processes could use at least moderate improvement.

- Help wanted: More than 70% of respondents indicate that their B2B accounts payable (AP) processes are at least half manually operated.

- Marginal costs: Nearly 60% of respondents indicate that the high cost of acceptance is a top 3 concern when accepting B2B payments.

Introduction

Every happy family is alike; each unhappy family is unhappy in its own way. —Leo Tolstoy

The Anna Karenina principle, outlined in the eponymous novel, illustrates a simple

lesson: Happy families share similar attributes, which indicates that these attributes are prerequisites to happiness and well-being. It is much the same in business where combining adherence to best practices, forward-thinking strategy, and tactical execution leads to business success. This report explores the often overlooked but business critical system of procuring goods and services from suppliers and receiving payments from customers. We begin by exploring B2B payment processes as a whole, before going on to look at the different components of a company’s B2B payment processes in the following sections.

Overall, just over a third (34%) of respondents indicate that their payment process fits their needs perfectly, while slightly more respondents (44%) report that their processes need significant improvement or overhaul (44%).

Which of the following best describes how well your company’s B2B payment processes meet your company’s needs?

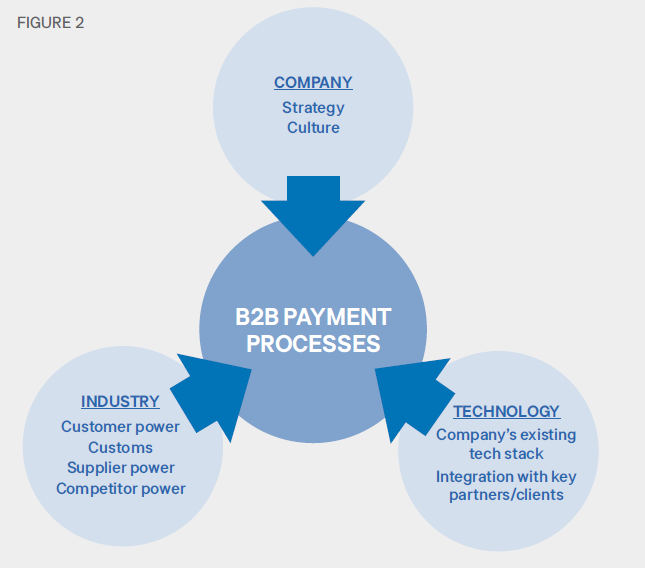

For the purposes of this research, it’s important to note the factors that drive satisfaction with B2B payment processes – some are within the company’s control, while others are far removed. Interviewees describe three key factors as determining the development and performance of a company’s B2B payment process: company foundation, industry, and technology.

The 3 Key Factors Influencing B2B Payment Process Development

Company, Industry & Technology Factors

Company

“We’re an older organization, so a lot of our payment processes were set up a long time ago,” explains one professional at a small construction company. He is describing a common situation – B2B payment processes using legacy systems and legacy payment methods (e.g. checks). It makes intuitive sense that older companies often rely on legacy systems; as the CFO at the construction company confirms, his predecessors understood how checks work – they themselves used them to pay bills – so that is the payment method

they adopted.

Company culture is a key strand that came up in the research interviews. A controller at a casino and gaming company describes her company as “not very forward-thinking.” She had just implemented an initiative to send monthly reminders to customers with outstanding balances and was fretting over the numerous emails she was receiving from team members voicing their concerns about what she referred to as a best practice.

The other key strand is company strategy: a CFO at an agtech company gives his number one priority as preserving cash balances – and he prefers that his team use checks for the float they provide. In contrast, another CFO, this time at a large logistics company, remarks that the float offered by checks is illusory; he sees his goal as structuring B2B payments to create advantage in a competitive industry, while ensuring that they are safe, secure, accurate, and timely.

Industry

“The casinos and gaming industry really struggled during the great recession,” explains one industry executive, “and our customers requested that we offer extended payment terms. Our company went from getting paid net 30 days to net 60–90 days.” She adds that the extended payment terms are still in effect. This is one example of customer power within an industry and how it has impacted the development of B2B payment processes.

In another instance, a CFO at a logistics company notes that companies within his industry are relatively undifferentiated, meaning that his team competes on price. Having to increase flexibility enough to offer the most competitive rates to customers has contributed to making the B2B payment system even more unwieldy. He sees the lack of standardization in his industry as another issue – he has to run two parallel B2B payment processes, with roughly 75% of orders automated and 25% processed more manually.

Technology

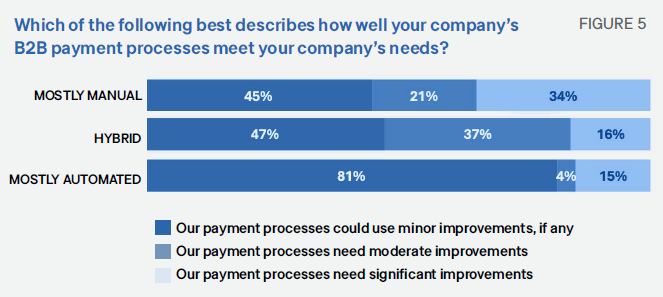

“It’s a little bit of a challenge for companies to find the best solution for their particular situation right now,” says a CFO at an IT company; “There are so many solutions available, but your back-office systems really dictate what you are able to do.” On the other hand, several newer companies participating in the survey describe their B2B payment system as both highly automated and a perfect fit for their needs (Figure 5). This makes it easy to see that B2B payments architecture is strongly correlated with process performance.

Putting it All Together

We’ve seen these factors featured prominently in research discussions and how they can indicate ways for companies to move forward. But it’s not quite as simple as that. There is little a company can do when it comes to disrupting industry pressures. And while adopting new technologies to boost an underperforming or overburdened B2B payment process is tempting, other interviewees are quick to mention that there is no panacea.

Still, the difficulty associated with B2B payment processes yields opportunity, says the controller at the casinos and gaming company, who posits that a finance professional applying a systematic and forward-looking approach to improving their B2B payment process can create competitive advantages. Even if such an advantage is marginal, it is often the difference between securing a new customer or retaining an existing one, especially in industries where just 1% or 2% makes all the difference.

The remainder of this report takes a deeper dive into the state of B2B payment processes today – looking at payment modalities, AP and accounts receivable (AR) systems, and the biggest challenges companies are facing – and outlines a structured framework to help finance professionals benchmark their own B2B payment processes and create a plan for their own process improvements.

The State of B2B Payments Today

Automation

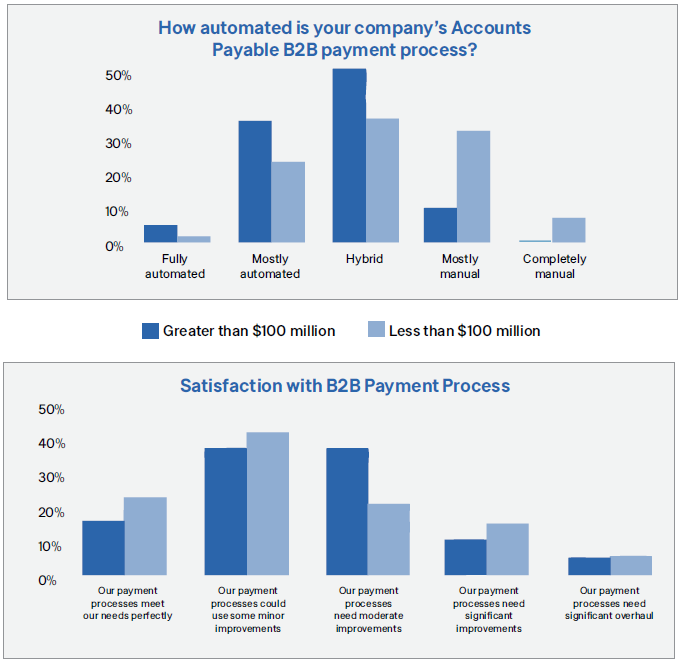

Although the benefits of B2B payment automation are well understood (i.e., greater accuracy, increased processing speed, fewer reconciliations), the data reveals that many companies have a long way to go in their efforts to automate AP and AR B2B payment processes. Overall, companies have progressed slightly further in automating their AR B2B payment processes (33% of companies have reached the level of mostly automated for AR B2B payment processes versus just 29% for AP B2B payment processes). As expected, larger companies (those generating more than $100 million of annual revenue) are further along in their efforts to automate B2B payment processes than smaller companies (those generating less than $100 million of annual revenue).

The introduction detailed the outsized impact a company’s technology has on B2B payment process performance; this is further evidenced in Figure 5, which demonstrates the degree to which automation drives B2B payment process performance. Notably, over 80% of respondents who have at least mostly automated their AP function report that their payment process fit their needs perfectly. Companies who are hybrid (i.e., they’ve automated roughly half of their AP B2B payment process) or mostly manual are significantly less satisfied with the performance of their B2B payment process, with only 47% and 45%, respectively, indicating that their payment process perfectly meets their needs.

Even so, the data points to a fascinating disconnect that recalls the three key factors from the introduction. The charts in Appendix A show that while larger companies are further along in their efforts to automate B2B payment processes (according to respondents, 40% of larger companies are at least mostly automated versus just 25% of smaller companies), they are also less likely to be satisfied with the performance of their B2B payment processes. This disconnect is a symptom of the misalignment between the expectations companies have for adopted automation solutions and the realities dictated by their foundational elements, the industry in which they compete, and the technological infrastructure they have in place. Yet as we see in Figure 6, the difficulty for many companies looking to further automate is not if but how to do it.

Digital Transformation

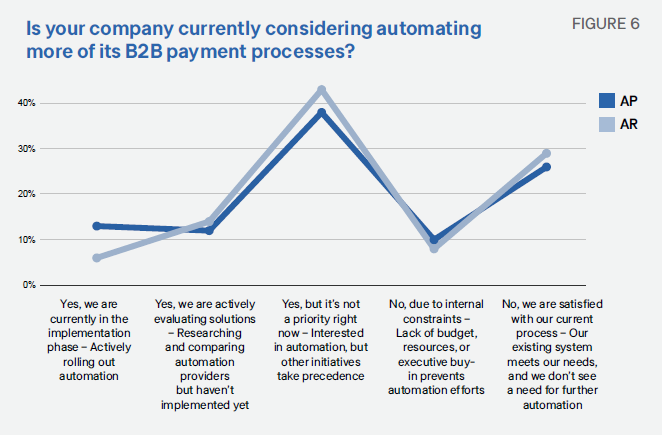

To better understand what companies are doing to automate their B2B payment processes, we asked respondents to consider further investments moving forward. The data from these questions serves as a complement to the story told in Figures 3&4– that is, AP automation is a slightly higher priority than AR automation. This makes sense given the narrow lead AR automation has over AP automation to date.

Interestingly, we see the impact of company strategy, priorities, and culture among other constraints limiting the ability for almost half of the respondents to make the necessary improvements to further automate their AP and AR B2B payment processes. Reasons for this include other initiatives taking place (around 40% of respondents for both AR and AP automation) and lack of buy-in and/or resources (around 10% of respondents for both AR and AP automation).

A CFO at a logistics company describes how complicated it is proving to automate B2B AR payment processes, mostly because his industry is so idiosyncratic when it comes to issuing and processing orders. Currently, about two-thirds of customers use one automated platform, while the rest use a different, more manual platform. Notably, he would prefer the legacy ERP system they use to process manual invoices

to send automated reminders to customers with outstanding balances, but enabling this feature would cost $10,000 per month – a figure he can’t justify. For now, he and his team are performing a build versus buy analysis and realizing that they might be better off finding an off-the-shelf product that “satisfices.” As he explains, although they could potentially build something that would give them exactly what they are looking for, he isn’t sure that is the best use of his team’s time and resources, so an 80% solution will have to do.

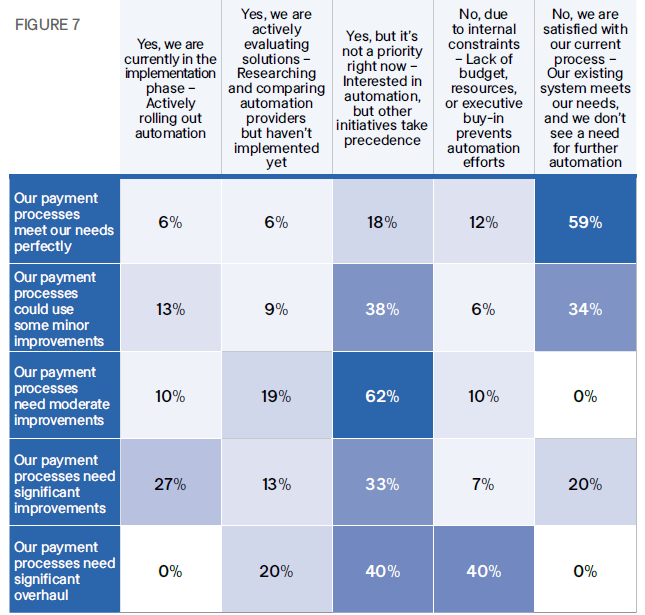

Reexamining the "Why" Behind Automation

Let’s examine this data a little differently in Figure 7 and reframe it in the context of how well a payment process aligns with a company’s needs. The percentages in the four corners are particularly salient; they paint simultaneously a sanguine picture for those whose payment process fits their needs perfectly and a far bleaker one for those whose payment processes need significant overhaul. Simply put, those AP

teams at finance organizations where the payment process is struggling aren’t going to get very much help from automation over time, with none of the respondents from this category indicating that they’re actively rolling out automation. Moreover, only 20% of respondents from companies whose payment processes need significant overhaul are even at the stage of looking at options.

Strategic Automation to Unlock Human Capital

We now know how important automation is in improving the performance of B2B payment processes – but all five interviewees also speak to its value in elevating employee performance. Companies can leverage this by converting the AP and AR components of the payment process from a hygiene business function into strategic advantage – that is, by enabling employees to serve as business ambassadors, working to solve problems and remove friction from business transactions. As an IT company CFO observes, “Sometimes you have to pick up the phone and make a call. People don’t always want to do it, but it is the best way to troubleshoot issues.” He further notes that it’s the aspects of good AP and AR processes that you can’t automate that can make a big difference.

Top-of-Mind Concerns and Challenges

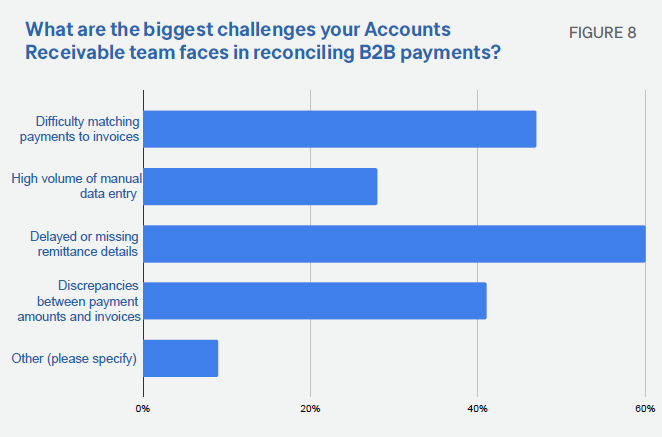

It’s to be expected that the most significant challenges to AR B2B reconciliations are delayed or missing remittance details and lack of standardization in payment formats. After all, both of these issues (60% and 52%, respectively) create significant friction for AR-specific B2B payment processes. For one CFO at a logistics company, the difficulty lies in having disparate payment formats and thus needing to maintain parallel processes. While this is an extreme case and one that is relatively industry specific, the issue of lack of standardized payment formats creates significant difficulty and can reduce the benefits of automation, depending on the degree of flexibility afforded by the company’s platform.

Regarding account reconciliations, one AR/AP employee at a large public biotech company notes that the lack of standardization in payment formats causes the workload to increase exponentially when it comes time for her to perform them, leaving her with less time to focus on troubleshooting other issues. A controller at a casinos and gaming company agrees that the time it takes to reconcile AR payments leaves her team struggling to take on any new initiatives; she also describes the considerable pushback when she started sending out monthly account statements to customers. The logistics company CFO relates a similar struggle for employees trying to find time to reach out to customers, hoping to convert them to a payment method that would simplify things for his team and free up bandwidth for other high-value initiatives.

Importantly, the challenges described here are all areas where employees can help create significant relational leverage and unlock business value.

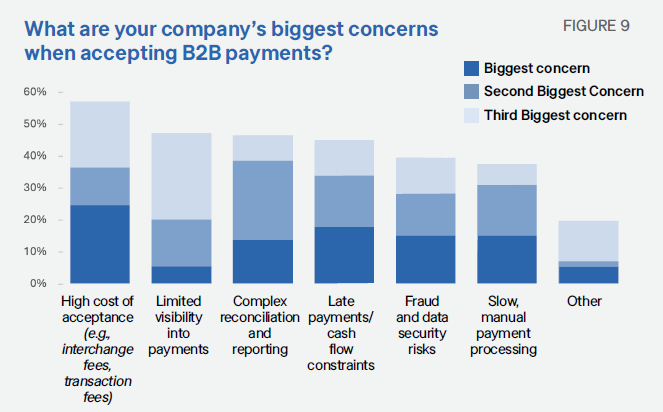

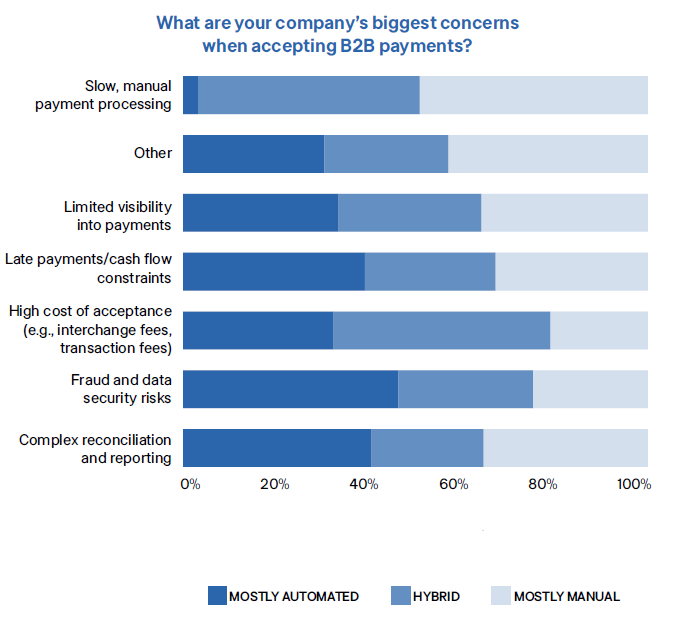

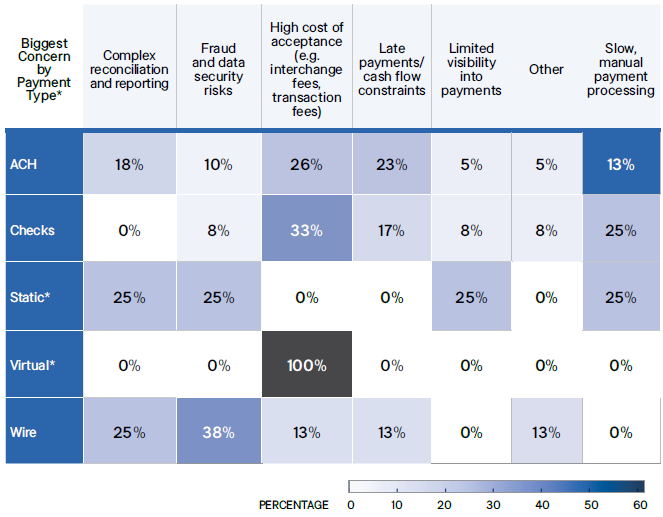

The high cost of acceptance is the most commonly cited concern for companies accepting B2B payments (almost 60% of respondents). While transaction fees and interchange fees are most commonly tied to receiving payments via commercial cards (static or virtual), we observe a noteworthy trend among those whose most commonly received payment type (as measured by total payment volume) is ACH/bank (26%) and/or checks (33%) – namely, the high cost of acceptance is their top concern (see Appendix 3 for further detail). While interchange fees and transaction fees are the most visible symptoms of the high cost of accepting payments, an agtech company CFO notes that companies also need to consider the implicit costs associated with acceptance, pointing to both the effort required to receive payments and the burden of processing those payments.

Another difficulty is having only limited visibility into payments. As a CFO comments: “Sometimes you get paid from a supplier and there are 80 invoices involved in the payment.” Having multiple invoices lumped together in one payment this way requires complex reconciliations.

Finally, companies that most commonly receive payments by wire note fraud and data security risks as their top concern. This makes sense given the preponderance of sophisticated fraud schemes in the market.

"We received an email from our vendor telling us that their account information had changed for future wire transfers. There was no current invoice to be paid, just a change in information. Still, it threw up a red flag because we’ve heard of this happening to other companies in our industry, so I dialed their CFO to ask about the change. It turned out they had been hacked and didn’t know.”

-A CFO from a Small Construction Company on Fraud in Wire Transferring

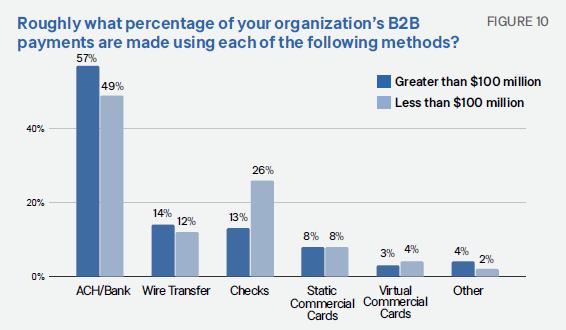

Payment Modalities

That various payment modalities are used is relatively unsurprising. As we can observe, the majority of B2B payments are made and received via ACH/bank withdrawal, and there is relatively little delineation in the B2B payment behaviors between large and small companies – the largest differences occur in paying and receiving payments via check. It makes sense for larger companies (i.e., those whose payment processes are more digitally based) to be less likely to use checks; after all, a digital B2B payment architecture functions best when the payments that flow through it are also digital. Still, the volume of payments via check is significant (almost 15% and 25%, respectively, of large and small companies’ B2B payments), given the disdain with which this payment method is universally described in the qualitative research discussions.

One controller at an IT company laments the endemic nature of checks: “It’s 2025, why can’t you do this digitally? The effort and cost associated with cutting a check are a major deterrent for us. We haven’t cut a check in three-plus years.” On the AR side, he is trying to wean his last remaining customers off checks.

A logistics company CFO shares similar frustration with checks and calls the “float” (the time between the check being issued and the funds being credited to your bank account) a mirage: “Even the float isn’t real … it’s a delay, and then your account is suddenly lower days or even weeks after you issued payment.”

Relatedly, another CFO notes that if you are after float, a credit card is better as it is a way to shrink days sales outstanding (DSO) for the vendor and increase days payable outstanding (DPO) for the customer. As noted in Section ii, almost 60% of survey respondents note the high cost of acceptance as their top concern when it comes to accepting B2B payments. Naturally there is a disconnect between a payment method that would otherwise be mutually beneficial for the customer and the vendor. A logistics company CFO relates his experience with commercial cards (virtual and static), noting that he receives 2% back when he pays via card but that the interchange fees required to accept payment via card would wipe out his company’s profit margin. Conversely, a controller at an IT company notes with regard to commercial cards that you have to meet the customers where they are. Notably, the profit margin for companies in the IT industry tends to be markedly higher than it is for companies in the logistics industry.

Thus, it is especially important for companies operating in industries where profit margins are low to create incremental advantages. Dean M. Leavitt, founder and CEO of Boost Payment Solutions, comments that using payment modalities strategically is one such method. In an interview with FERF researchers, he outlines one tactic by which he has seen companies in the logistics and other low-margin industries create alpha – that is, early payment discount arbitrage. While the tactic’s benefits are typically considered from the customer’s side, vendors should be just as keen to create such payment arrangements. In an early payment discount arbitrage, a vendor offers a discount to incentivize early payment (e.g. 2% if the balance is paid in the first 10 days). Vendors can create an arbitrage arrangement in which they are paid earlier by permitting the customer to pay with a card. As aforementioned, interchange fees can be a point of friction between vendors and customers. In this case, the vendor and the customer typically negotiate to lower the early payment discounted rate for the customer down to 1% from 2% in order to offset a portion of the interchange fees. The customer can increase their DPO and potentially receive cashback, depending on their card, while the vendor receives immediate payment. Returning to our survey results, finally, a small percentage of payments by volume are performed via “other” methods. In one interview, a company executive explains that they have significant foreign operations and so typically use the currency in which the foreign company is domiciled. Exchanging foreign currencies for USD can be expensive and time-consuming, so her company first converts the foreign currency into digital currency then exchanges the digital currency for USD. She notes that she would prefer to be paid in digital currency, which would allow her to skip a step, and is

working on implementing this.

Although the focus of this research is on B2B payments, it is worth noting that digital currencies appear to be an area of interest and tremendous growth, given the rise of digital asset companies through 2025, among other notable tailwinds. That said, for one controller out there, digital currencies are working well, and she believes that businesses will become more enthusiastic about incorporating them into their B2B payment strategy, whether digital currencies will emerge as a payment modality featuring in B2B transactions remains to be seen.

Conclusion

A Framework for B2B Performance Improvement

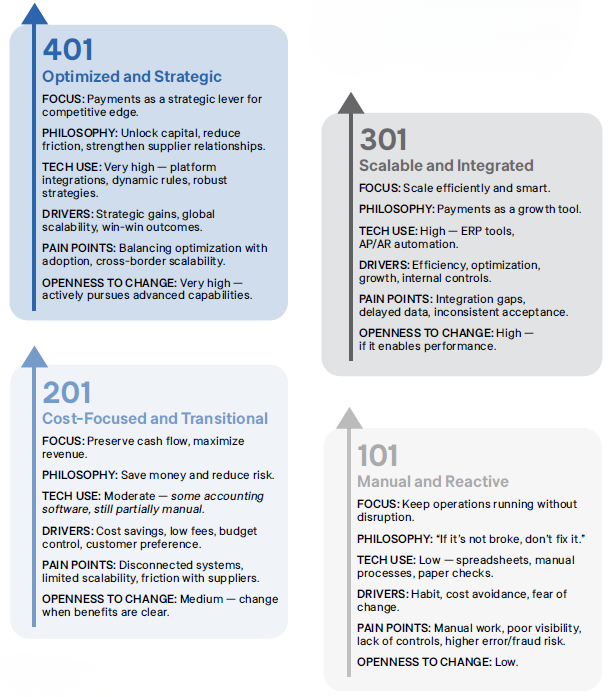

The existing B2B payment architecture is antiquated at many companies. Moreover, we expect continued evolution to a more digital architecture moving forward. As changes occur, finance teams will need to assess their own processes and infrastructure and consider whether a more digitally focused strategy is necessary for issuing and receiving B2B payments. As such, there is an opportunity for enterprising finance teams to create alpha. To rephrase the question posed earlier, then, it is now more a case of what improvements to make, and how.

Through our research into B2B payment processes, we identified notable trends in how companies, both large and small, are navigating the complex ecosystem of B2B commerce. The introduction discussed key determinants that influence the development of company B2B ecosystems. Based on qualitative research discussions with experts and finance professionals, we have aggregated the observed practices into four categories of B2B payment processes. And while we recognize the impact of constraints, we note the competitive advantage of being just 1% or 2% better than competitors at any one thing. Simply put, and to use the old aphorism, when it comes to industry competitiveness, B2B payment practices are tantamount to being just faster than your competitor when it comes to outrunning the proverbial grizzly bear. Thus, the goal is not necessarily to move not from category 1 to category 4 but from category 1 to category 2. As with anything in finance and accounting, transformation is best accomplished when it is measured and measured.

Each interviewee describes their goal as simplifying B2B payment processes by increasing levels of automation. But not all finance teams are able to increase automation due to budget constraints and/or lack of institutional support. Others are seeking to simplify their payment processes through harmonizing payment methods. Still, there is a balance between meeting the customers where they are and simplifying payment processes. In such a case, the human component of B2B payment processes becomes increasingly important as a means to both understand the customer preference for a particular payment modality and collaborate to find mutually beneficial solutions.

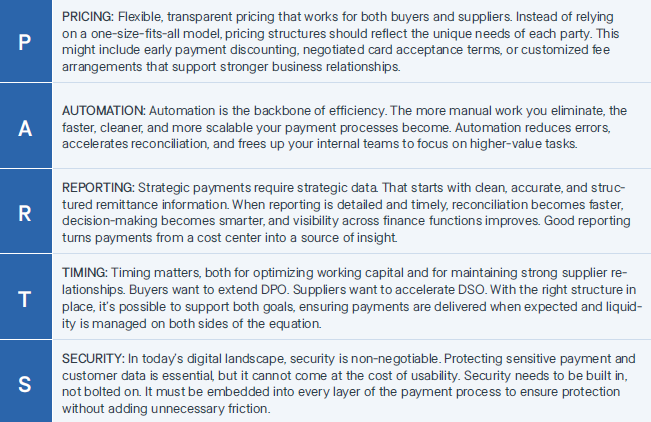

The P.A.R.T.S Framework

Boost Payment Solution’s CEO and Founder Dean M. Leavitt on Payment Process Excellence

As finance leaders begin re-evaluating their payment processes, what questions should they ask?

The key question is: Are we truly optimizing how we pay and get paid? That question alone opens the door to a range of considerations — economic, operational, and technical.

At Boost, we use a framework called P.A.R.T.S. to help answer that question. It’s how we define and measure true optimization across every layer of the B2B payment process for all parties involved. There are a lot of moving parts in any payment flow, but these five pillars serve as the foundation for transforming payments from a necessary function into a strategic advantage.

If you’re not hitting all five parts of P.A.R.T.S., you’re not fully optimized. You might be functional, but you’re likely leaving efficiency, savings, and relationship equity on the table. This framework is how we design, implement, and evaluate every solution we bring to market, because in our view, that’s what modern enterprise payments require.

Appendices

Appendix A: Data Disconnect

Appendix B: How Automation Impacts the Types of Problems an AR Team Faces When Reconciling B2B Payments

Appendix C: How a Company's Dominant Payment Type Influences Its Top Concerns with Receiving B2B Payments

*Respondents are grouped based on their most commonly received B2B payment type. Static/ Virtual commercial cards are the least common dominant payment type, which is to be expected given their volume of use as a payment method, as illustrated in Section II.iii on payment modalities. Importantly, the figures presented for these payment methods are less likely to represent the universe of companies for which their dominant payment method is commercial cards. Every other payment method has a sufficiently large sample size.

About the Research

The Financial Education & Research Foundation (FERF) and Boost Payment Solutions collaborated to develop a research survey and interview questions designed to address the state of B2B payment processes today, uncovering the existing pain points companies are dealing with and how they’re transforming their B2B payment processes as they seek to compete in the digital age. The report and its findings are based on a survey distributed to Financial Executives International (FEI) members, with representatives from over 130 companies participating. To supplement the survey findings, FERF researchers conducted interviews with finance professionals from five different companies, representing agtech, information technology (IT), gaming, logistics, and construction.

Download The Report

About Boost

@Boost Payment Solutions