Smarter Automation with

Bank of America & Boost

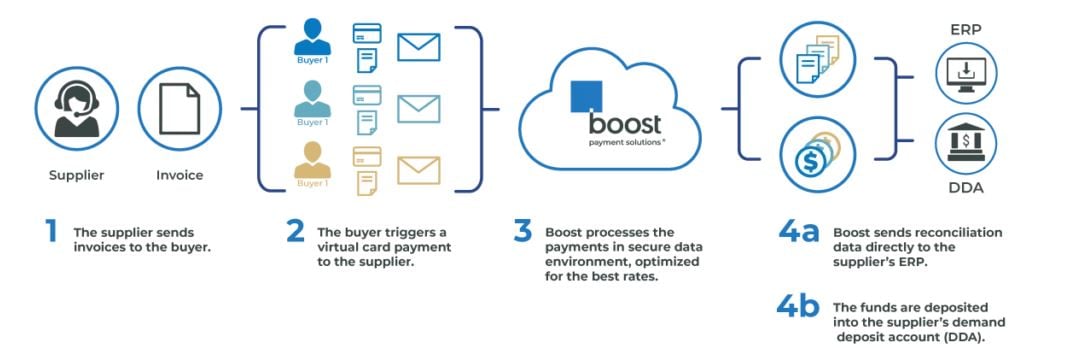

Boost and Bank of America have simplified virtual card payment processing. Boost’s push payment solution, powered by Boost Intercept®, turns virtual commercial card payments into a completely passive experience, reducing physical administration, mitigating fraud and addressing cash flow issues.

Advantages of the Digital Payments Program Include:

Simplified Reconciliation

Enhanced automated remittance provided with email notifications

Simplified Reconciliation

Enhanced automated remittance provided with email notifications

Automated Payment Processing

Payments are direct deposited to your bank account with no manual work

Automated Payment Processing

Payments are direct deposited to your bank account with no manual work

Questions?

Please reach out to Boost Payment Solutions at supplierenablement@boostb2b.com.

To speak to your Boost Team Member directly, please schedule a consultation below.

Payments via the Boost Program

Avoid high processing costs typically associated with payments accepted via card and enjoy all the benefits of end-to-end automation. Save time and money by upgrading to the most secure B2B payment processing method available. Payments will be direct deposited to your bank account upon current terms.

FREQUENTLY ASKED QUESTIONS

Virtual credit cards are a flexible electronic payment method using 16-digit credit card numbers typically created for purchases at set amounts. Most commonly sent via email, they offer convenience, security, and speed in the B2B payments space. Virtual cards can improve accounts payable (AP) processes, benefitting both buyers and suppliers by streamlining day-to-day payments, and providing greater control over cash flows. They also offer more safeguards against fraud than traditional business credit cards.

Boost processes virtual cards in an automated way, eliminating manual processing steps.